https://www.tradingview.com/chart/tKlgCet5/

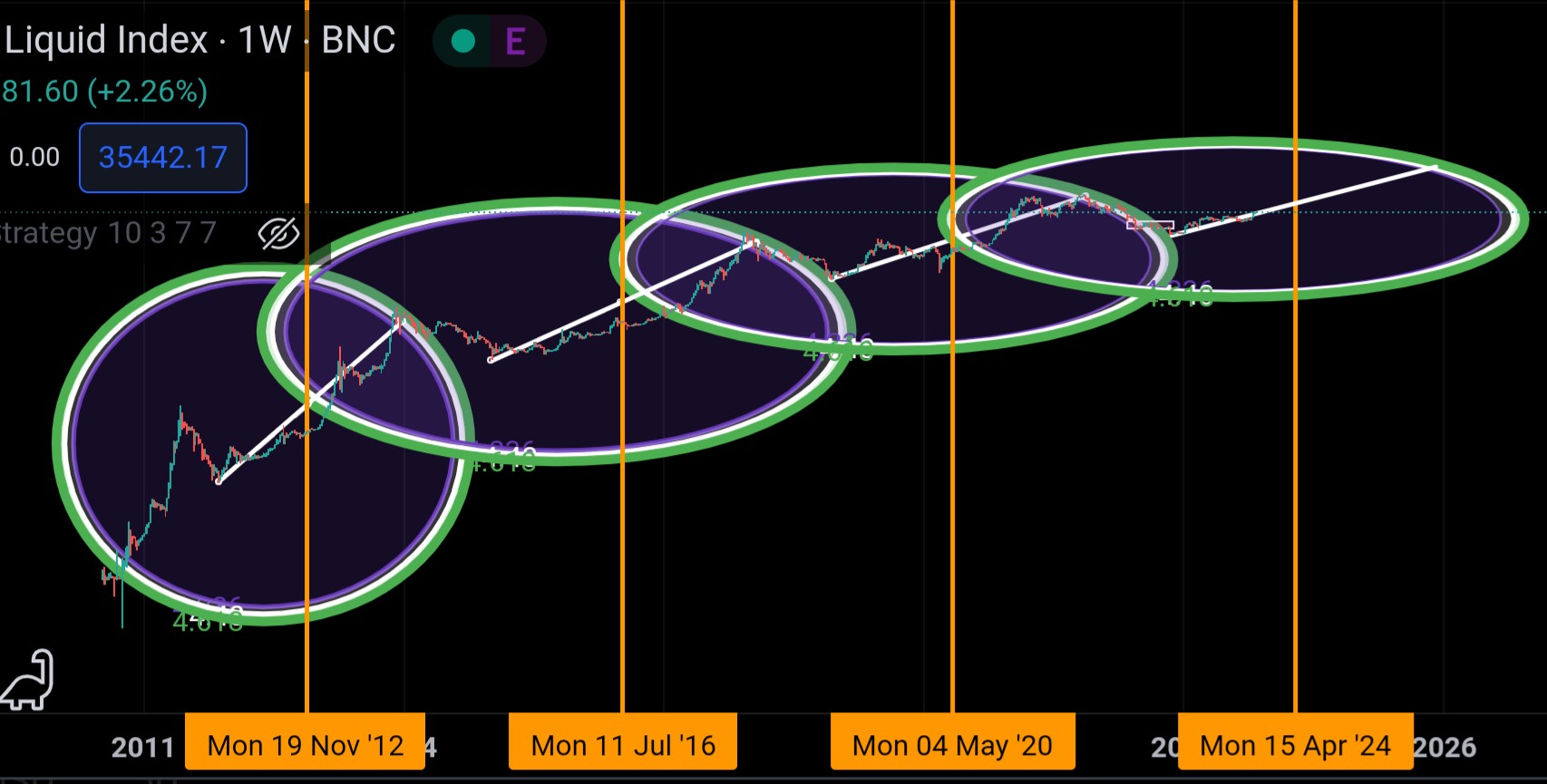

Welcome to a novel approach to understanding Bitcoin's price action. As a staunch Bitcoin maximalist, I believe in the inherent value and transformative potential of this asset. As the world economy starts to wake up and reprice itself against this new asset, it helps to help a tool to keep you calm and know how to plan accordingly. Let's delve into the "Satoshi Circles" method and how it might provide insights into Bitcoin's future price movements.

The Genesis of Satoshi Circles:

Drawing inspiration from the mysterious Bitcoin creator, Satoshi Nakamoto, the "Satoshi Circles" method integrates the application of Fibonacci circles with Bitcoin's halving events. Here's a brief step-by-step guide:

Identify Halving Events: Mark the date of each Bitcoin halving event with a vertical line on your chart.

Draw Trend Lines: From the low of each cycle, draw a trend line to the corresponding halving event.

Overlay Fibonacci Circles: Using the chart data from the trend line during the timeframe from the cycle's bottom to the halving, overlay a Fibonacci circle. If done accurately, this circle will offer insights into potential market tops.

Accuracy and Margin of Error:

No method, however ingenious, offers precise predictions every time. With the "Satoshi Circles" method, there's a margin of error to be mindful of:

Trend Line Precision: Ensuring accuracy when drawing the trend line is crucial. Small deviations can significantly alter predictions.

Bitcoin's Volatility: As an asset, Bitcoin is susceptible to global events, regulatory changes, and macroeconomic factors that may disrupt technical patterns.

Fibonacci Circle's Range: The actual top could materialize anywhere within the designated Fibonacci circle. Thus, it's not about pinpointing an exact price but identifying a probable range.

Looking Forward to April 2024:

It's worth noting that the true potential of the "Satoshi Circles" method can't be fully realized until after the April 2024 halving. Post this event, critical data points such as the bottom price and halving date will be solidified. Consequently, the Fibonacci circle can be appropriately placed, and the preceding trend line can be extended to intersect with the circle, unveiling the possible top range. This anticipation builds a compelling case for closely monitoring Bitcoin's journey post the forthcoming halving.

Conclusion:

While the "Satoshi Circles" approach offers a fresh perspective on predicting Bitcoin's price action, it's always vital to approach trading and investments with caution and diligence. Macroeconomics can change quickly and the world could see that Bitcoin's potential remains vast much faster than anticipated, but as HODLers of the hardest money on Earth, it's our responsibility to keep calm and spread the word.

We are all Satoshi.

Adam Malin

You can find me on Nostr at:

npub15jnttpymeytm80hatjqcvhhqhzrhx6gxp8pq0wn93rhnu8s9h9dsha32lx

You can view and write comments on this or any other post by using the Satcom browser extention.

value4value Did you find any value from this article? Click here to send me a tip!